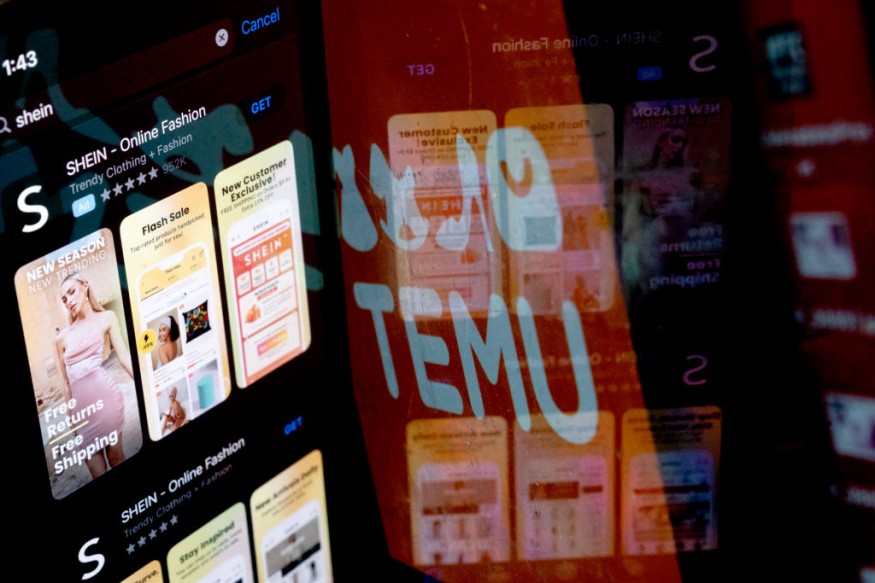

E-commerce giants, Temu and Shein, are rapidly transforming the global toy market as they expand their offerings during the lucrative holiday shopping season.

Known for low-cost products, the platforms are now seeing significant growth in toy sales, challenging traditional retail giants like Amazon, Walmart, and Target, which still dominate 70% of US toy sales, according to research firm D.A. Davidson.

Shein and Temu See Holiday Toy Sales Boom Amid Rising Online Bargain Hunting

Shein has reported double-digit growth in toy sales year-over-year, while Temu has observed a surge in toy-related searches.

According to market research firm Kantar, 13% of US shoppers plan to buy holiday gifts from Temu this year, up from 9% in 2023. Credit card spending data from Facteus also shows increased consumer spending on both platforms compared to last year.

These platforms have become attractive to budget-conscious shoppers, especially those earning less than $50,000 annually, a demographic hit hardest by rising consumer prices since 2021.

Bank of America data highlights the trend, with more low-income shoppers seeking bargains online. In Europe, a study by Circana revealed that 39% of consumers have purchased toys or games from platforms like Temu, Shein, and AliExpress in 2024, with the figure climbing to 60% among younger shoppers aged 18 to 34.

Even established toy manufacturers are taking notice. MGA Entertainment, known for its L.O.L.

Surprise! dolls, is exploring partnerships with these platforms to broaden its reach. CEO Isaac Larian emphasized the importance of targeting all income levels to maximize market potential, Invezz said.

However, the rapid growth of Shein and Temu in the toy sector has sparked concerns over counterfeit and unauthorized products. Mattel, the creator of Barbie and Hot Wheels, does not sell directly to these platforms.

Yet, listings for its products, including Uno cards, have appeared on Temu and Shein with claims of authenticity.

Distributors Embrace Shein and Temu Despite Counterfeit Challenges

Both platforms have responded to these issues. According to Reuters, Shein states that suppliers must certify product authenticity, while Temu removed unauthorized listings and initiated investigations to address intellectual property violations.

MGA and Spin Master, the maker of "Ms. Rachel" dolls, have raised safety concerns over counterfeit items, citing improper age labels and potential choking hazards.

Despite these challenges, Temu and Shein continue to appeal to distributors like Popmarket, which plans to expand its offerings on both platforms post-holiday season.

Fat Brain Toys, however, remains cautious, with its president stating the company will only join if the platforms align with their standards.

As the global toy market, valued at $108.7 billion in 2023, evolves, Temu and Shein are reshaping consumer habits by making low-cost toys more accessible to shoppers worldwide.